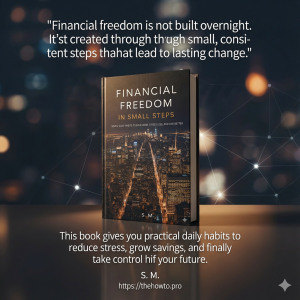

Financial Freedom in Small Steps is a practical guide that helps you build true financial freedom through small, simple actions—completely free from complicated strategies or the traditional approaches that rely on deprivation or strict budgeting. The book explains—as stated clearly in its introduction—that money isn’t just numbers; it is a force that shapes your sense of security, freedom, and your ability to make better decisions in life. It’s built on a powerful idea: “Wealth is not created through big leaps… it’s built through small, consistent daily habits.” Through ten clear and actionable chapters, the book guides you—step by step—toward building a solid financial foundation through:

- Transforming Your Money Mindset

Shifting from a scarcity mindset to one of abundance, and removing the limiting beliefs that block financial success (as explained in Chapter 1 on Money Mindset) Financial Freedom in Small Steps.

- Tracking Your Money Without Complexity

Simple, effective methods to understand where your money goes—without boring spreadsheets or overwhelming systems.

- Saving Small Amounts That Create Big Results

The book demonstrates the power of Micro-Saving, showing how even $5 a day can create meaningful financial change over time.

- Eliminating Debt Step by Step

Strategies such as the Debt Snowball and Debt Avalanche, supported by real examples from the book, to help readers break free from debt in a realistic, sustainable way.

- Smart Spending Without Deprivation

The concept of conscious spending, which allows you to spend freely on what you love while reducing spending on what doesn’t matter—turning money into a tool for comfort, not stress.

- Building a Strong Emergency Safety Net

A clear, structured plan to build an emergency fund that protects your finances from unexpected setbacks (as described in Chapter 6 of Financial Freedom in Small Steps). Easy, Accessible Ways to Start Investing Investing isn’t just for the wealthy—the book explains how to begin investing with small amounts, using simple tools and strategies, along with real-life examples of beginners who successfully grew their wealth over time.

- Daily Money Habits That Guarantee Long-Term Freedom

The book emphasizes the power of small daily routines—like five-minute account check-ins and tiny automatic transfers—that anyone can apply to build financial strength and consistency.

What’s Inside!

Why this book is different!

-

- Written for real, everyday Americans—not finance experts

-

- Built entirely on small, doable, sustainable steps

-

- Combines psychology + behavior + simple math

-

- Zero fluff. Zero guilt. Zero gimmicks.

Method & Evidence

This method is based on:

-

- Behavioral psychology

-

- Habit formation science

-

- Real case studies from people who changed their lives with tiny steps

-

- Proven micro-actions that reduce stress and increase financial clarity

-

- Systems that require minutes per day, not hours

-

- Reviews

-

- ⭐️⭐️⭐️⭐️⭐️ — “This book finally made budgeting feel doable. I paid off two debts in 60 days.” — Melissa T., Florida

-

- ⭐️⭐️⭐️⭐️⭐️ — “Simple, clear, and REAL. No guilt, no judgment—just steps I can actually follow.” — Raymond S., Toronto

-

- ⭐️⭐️⭐️⭐️⭐️ — “The micro-saving chapter alone changed everything for me.” — Angela D., Michigan

-

- ⭐️⭐️⭐️⭐️⭐️ — “I’ve read many money books. This is the only one that didn’t overwhelm me.” — Carlos R., California

-

- ⭐⭐⭐⭐⭐ — “As a newcomer to Canada, this gave me the roadmap I desperately needed.” — Hadi K., Vancouver

Reviews

There are no reviews yet.